🧠 Introduction

Withdraw GCash to bank in 2025 easily and securely with this complete step-by-step guide. If you’ve ever had transfers fail, delays, or high fees — this updated method will help you send money fast, with zero mistakes.

Whether it’s BDO, BPI, Metrobank, or UnionBank, this guide works with all major Philippine banks. We’ll also cover:

-

How to reduce fees

-

What to do if something goes wrong

-

Updated limits and processing times

🔹 Step 1: Launch the GCash App

Start by opening your GCash app and logging in:

-

Input your registered mobile number

-

Enter your 4-digit MPIN

-

Ensure your GCash balance covers the transfer amount

-

Update the app to the latest version (2025)

✅ Never transfer using outdated app versions. It may fail or not show updated banks.

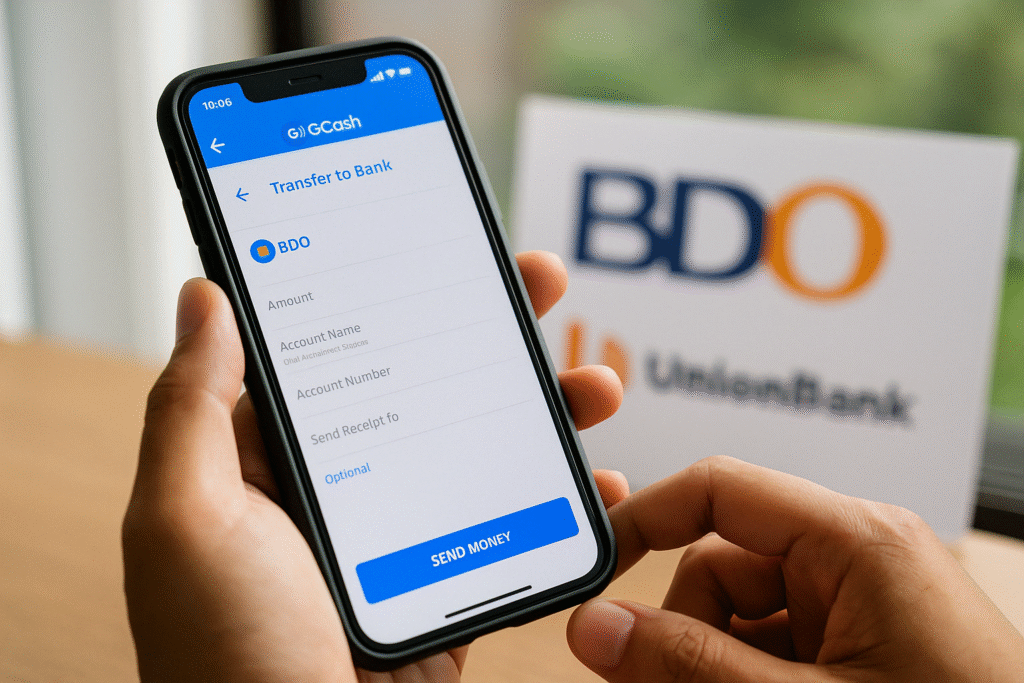

🔹 Step 2: Go to the Bank Transfer Section

-

From your GCash dashboard, tap “Transfer”

-

Then tap “Bank Transfer”

-

You’ll see a list of 40+ partner banks including:

-

BPI

-

BDO

-

Metrobank

-

UnionBank

-

RCBC

-

Landbank

-

🔹 Step 3: Enter the Correct Transfer Details

Fill in these required fields:

-

Bank Name

-

Account Name (must match bank records)

-

Account Number

-

Amount

-

Email (optional) – for receiving a receipt

🔒 Triple-check your account number. Wrong input = failed or lost transaction.

🔹 Step 4: Confirm and Complete Transfer

-

Tap “Send Money”

-

Review the transfer details one last time

-

Tap “Confirm”

-

Wait for the confirmation screen

-

You’ll receive an SMS or email receipt

✅ Your transfer now appears in the “Transaction History” tab

🕒 GCash Bank Transfer Processing Time (2025)

| Bank | Typical Time |

|---|---|

| UnionBank | Instant |

| BPI | 1–2 mins |

| Metrobank | 5–10 mins |

| Landbank | 10–15 mins |

| RCBC | 15–30 mins |

⚠️ Transfer delayed more than 24 hours? Contact GCash support with your reference number.

💸 Fees for GCash Bank Transfer in 2025

| Type of Fee | Amount |

|---|---|

| Standard Instapay Fee | ₱15 |

| GSave to Bank Transfers | Free |

| Monthly Free Transfers | 3 per month (via Rewards) |

🎁 Go to the GCash Rewards tab to redeem free transfer vouchers.

🛑 Common GCash Transfer Mistakes & Fixes

| Problem | Solution |

|---|---|

| Wrong account number | Contact GCash Support immediately |

| Bank not listed | Use “Others via Instapay” |

| Transfer stuck | Wait 24 hours, then contact support |

| Sent to wrong bank | Cannot be reversed. Double-check details next time |

🔐 Security Tips for Bank Withdrawals

-

✅ Use only the official GCash app

-

✅ Don’t share your PIN or OTP

-

✅ Always double-check the account number

-

✅ Log out when using shared devices

-

✅ Don’t transfer over public Wi-Fi

❓ Frequently Asked Questions (FAQs)

🔹 Can I cancel a GCash bank transfer?

❌ No. All transfers are final once confirmed.

🔹 What’s the daily limit for transfers?

-

Basic: ₱50,000

-

Fully Verified: ₱100,000

🔹 Can I withdraw from GCash using an ATM?

Yes — using your GCash Mastercard at supported ATMs. (Fee: ~₱15–₱20)

🔹 Is GCash safe in 2025?

✅ Yes. It is regulated by Bangko Sentral ng Pilipinas (BSP) with bank-grade encryption.

👉 Read also: Top 10 GCash Earning Apps in 2025 (No Investment Needed)

👉 GCash Help Center – Bank Transfer

Before you withdraw, why not boost your GCash balance?

withdraw gcash to bank in 2025

🔗 Discover: Best Apps That Send Money to GCash in 2025

Start earning today, and cash out tomorrow.

withdraw gcash to bank in 2025